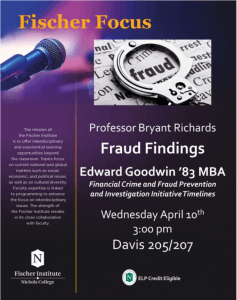

- The April 10 event, “Fraud Findings,” is sponsored by the Nichols College Office of Academic Affairs and Fischer Institute and is free and open to the public; it starts at 3 p.m.

By LORRAINE U. MARTINELLE

DUDLEY, Mass.—An expert in financial crime, forensic accounting, and fraud prevention will speak April 10, 2019, at Nichols College, in Davis Hall, Room 205/207 on Center Road. Edward A. Goodwin ’83 MBA will address how United States law enforcement and regulatory agencies have changed over the past decade, such that money laundering is now treated as an independent, primary focus; as well as how agencies and financial institutions help combat financial crimes and terrorism.

Goodwin, of West Boylston, has extensive experience in the Bank Secrecy Act of 1970, anti-money laundering (AML), international and domestic financial crimes case investigation, elderly financial abuse investigation, “politically exposed people monitoring,” and white collar and business crime investigation. He retired as assistant vice president Bank Secrecy Act AML officer from Middlesex Savings Bank, and held similar positions at Millbury Federal Credit Union and State Street Bank in Boston. Goodwin obtained an MS in criminal justice from Northeastern University, an MBA from Nichols College, and a BA from the College of the Holy Cross. He also received certification from the American Institute of Banking Massachusetts, Massachusetts Bankers Association Compliance Academy, American Bankers Association, and the Massachusetts Department of Correction Officer Training Academy.

“Attendees will leave with an appreciation for how prevalent financial crimes are in our daily lives as well as an appreciation for what those on the front lines do to protect us,” said Associate Professor of Accounting and Finance Bryant Richards, chair of the Nichols undergraduate accounting program.

Financial crime investigation is a growth opportunity area for current and aspiring professionals. The combination of accounting, finance, and criminal justice skills are highly desirable sets to employ in the fields of anti-money laundering and financial crime prevention/investigation.

In addition to Nichols students, the two-hour seminar is geared toward those working in law enforcement, financial institutions, security firms, and also business owners. Attendees will develop and understanding of risk and prevention for personal, professional, and business reasons. They’ll also learn how enforcement agencies, organizations, and regulations are empowered to monitor, report, investigate, and prevent domestic and international money laundering.

The April 10 event is sponsored by the Nichols College Office of Academic Affairs and Fischer Institute and is free and open to the public; it starts at 3 p.m. The Southern New England Chapter of the Institute of Internal Auditors is providing Continuing and Professional Education (CPE) credit to accounting professionals.

NICHOLS COLLEGE’S ROBUST ACCOUNTING PROGRAM

Last fall, Nichols launched an industry-focused online accounting degree program that trains students to meet the profession’s modern needs. Students would earn a Bachelor of Science in Business Administration and could conveniently complete their entire degree online, part-time or full-time.

The online accounting program is being introduced through Nichols College’s Undergraduate Adult Education Program (UAEP), which already offers online BSBA concentrations in general business and human resource management, as well as a hybrid on-campus/online model for concentrations in accounting, criminal justice management, hospitality management, and management. With student schedules and priorities in mind, the UAEP curriculum consists of seven-week courses that concentrate the material usually covered over a full semester, and are offered on a consistent rotation. Courses are taught by Nichols professors who are trained and skilled in maximizing students’ learning potential online. Nichols accounting faculty have extensive professional accounting experience and are passionate about training students to excel in corporate, government, and nonprofit environments.

The online accounting program is being introduced through Nichols College’s Undergraduate Adult Education Program (UAEP), which already offers online BSBA concentrations in general business and human resource management, as well as a hybrid on-campus/online model for concentrations in accounting, criminal justice management, hospitality management, and management. With student schedules and priorities in mind, the UAEP curriculum consists of seven-week courses that concentrate the material usually covered over a full semester, and are offered on a consistent rotation. Courses are taught by Nichols professors who are trained and skilled in maximizing students’ learning potential online. Nichols accounting faculty have extensive professional accounting experience and are passionate about training students to excel in corporate, government, and nonprofit environments.

In addition to teaching traditional accounting concepts, the new online accounting program includes significant enhancements in technology instruction.

“According to professional institutes and industry stakeholders, accounting professionals need deeper technology skills,” explained Richards. “As such, Nichols College is adding technology instruction in as many places throughout existing courses. In addition, we have added two required courses: accounting information systems and advanced analytics for accountants.”

As part of the online program’s industry-focused approach, the curriculum was developed to address professional accounting institute-provided competencies (American Institute of Certified Public Accountants, Institute of Management Accountants, and Institute of Internal Auditors). The College’s accounting department also keeps up with developments in the field—from forensic accounting and new regulations and requirements, to changing international accounting standards.

“We learned that the accounting profession has become larger and more specialized than can be supported by a traditional accounting program,” said Professor Richards. “As a result, Nichols College provide electives that allow students to explore five different possible paths, which all line up to professional institutes: Certified Public Accountant/CPA (audit/tax), Certified Management Accountant/CMA (analyst/controller), Certified Information Systems Auditor/CISA (IT audit/data analyst), Certified Fraud Examiner/CFE (fraud), and Certified Internal Auditor/CIA (internal audit/compliance).”

MEETING EMPLOYER NEEDS THROUGH PARTNERSHIPS

Similar to the Nichols College Graduate and Professional Studies Master of Science in Accounting degree partnership with Wolf & Company, undergraduate faculty are looking to collaborate with industry partners to provide a deeper, more industry-focused experience for Nichols bachelor program students. The Nichols/Wolf custom MSA’s benefits are twofold: For Wolf & Company employees, they earn the 30 additional credits required to become a CPA, while avoiding courses they may have already taken during their undergraduate years; and they’re gaining technology and “people” skills—all at no cost to them and paid for by Wolf. Meanwhile, Wolf benefits from employing talented accountants and auditors who have the cutting-edge skills needed to succeed in the workplace of today and tomorrow.

To date, the Nichols undergraduate accounting program has established the following partnerships:

- Association of Certified Fraud Examiners Anti-Fraud Education Partnership: Nichols College offers an ACFE fraud examination elective course. It comes with their material and is taught by a certified fraud examiner.

- IDEA Academic Partnership: Audimation Services is a provider of one of the top auditing analytics software programs used in industry. The Advanced Analytics for Accountants class will primarily focus on methodology and use of this tool in simulated scenarios. The partnership provides software licenses, data sets and classroom material to provide students the opportunity to graduated having had deep data analytics experience.

Nichols accounting students are in high demand, as illustrated by the 20 firms and companies that recruited students at the September 2018 Nichols College Accounting & Finance Career and Internship Fair. In addition, the College’s active network of successful accounting alumni provides students with excellent internship and employment opportunities. For example, students have worked at AAFCPAs, PwC, Bollus Lynch, MAPFRE, Cyient, Mohegan Sun, and the Center of Hope Foundation.

“At Nichols, we believe it is important to help expose students before they graduate to areas that capture their interest,” said Professor Richards. “Giving them elective choices that are aligned with professional paths gets them to start asking the question early of ‘What type of accountant am I?’”

The U.S. Bureau of Labor Statistics estimates an 11 percent growth rate in accounting and auditing jobs between 2014 to 2024, faster than the average for all occupations. This growing, global market needs skilled, educated leaders.

For more information about the online accounting program, call or email Laura Hunter, director of the Nichols College Undergraduate Adult Education Program, at 508-213-2141 or Laura.Hunter@nichols.edu.